Inter relationship of variable affecting exchange rates

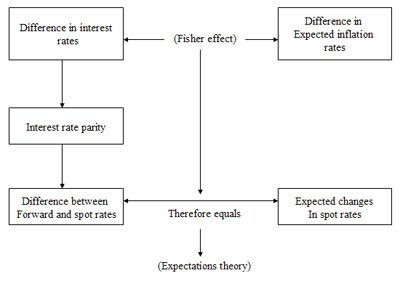

Interest rate, inflation rates, forward margins, exchange rates and expectation across nations are inter-related as shown in the diagram below.

The diagram below suggests that interest rates vary across countries because of varying expectations with regards to their rates of inflation. Under perfect competition, funds would move to a country where real interest rate (nominal interest rate less inflation rate) is higher, till the forces of demand and supply equiliberate them. In other words, the difference in interest rates between countries is equal in equilibrium to the expected difference in the inflation rates.

The expected difference in inflation rates between two countries equals, in equilibrium, the expected movement in spot rates. The forward rate for a given period, say 6 months, should equal the spot rate 6 months hence. The difference between the forward rate and the present spot rate represents the interest element for the period of the forward rate. In reality, the future spot rate would usually be higher or lower than the forward rate.

Relationship of variables affecting exchange rates

Exchange rate movements overtime are influenced by various factors not only those mentioned above but also by market imperfections arising out of official intervention in markets, exchange control restrictions, custom barriers, etc.