Notes on Audit of Ledgers – Guidelines to Auditors

Table of Contents

Audit of Ledgers

An auditor should carry out Audit of Ledgers after the books of original entries have been vouched and postings there from are fully checked.

In business, personal ledgers such as purchases ledger and sales ledger are maintained to record credit transactions. In purchase ledger, all credit purchases are recorded in the names of suppliers. Similarly, in sales ledger, all credit sales are recorded in the names of debtors. A purchase ledger is also known as sundry creditors ledger or accounts payable ledger. Sales ledger is also called sundry debtors ledger, or accounts receivable ledger.

The cash book, purchase book, sales book, sales return book, purchase returns book are to be totaled periodically and the summary is posted in the general ledger,

All those entries that cannot be recorded in any other book of prime entry are recorded in journal. Opening entries, closing entries, adjustment entries, rectification of errors and entries relating to share capital are usually passed through journal.

In view of the above, different ledgers that have to be scrutinized are Bought ledger, Sales ledger, General ledger and Main journal. The bought ledger consists of creditor’s accounts.

1. Scrutinizing Purchase Ledger

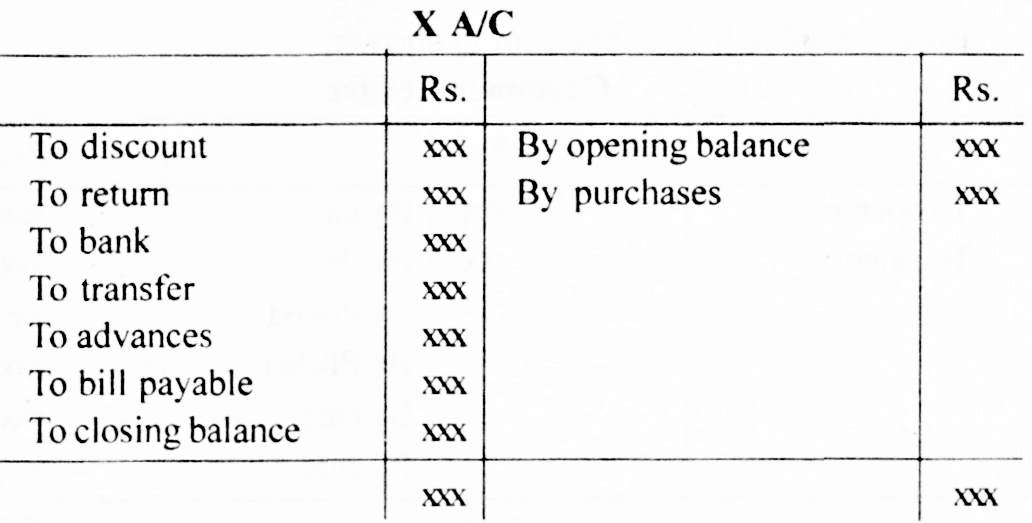

A model of a creditor’s account is given.

The auditor should take into account the following points while auditing purchase ledger.

Opening balance

The auditor should check the opening balances of different accounts in the bought ledger with the previous year’s audited balance sheet or the schedule of creditors duly checked during previous audit.

List of closing balances

The list of closing balances of creditors should be verified with the purchases ledger. The control account of the above ledger in the general ledger should be tallied with the total of the list of balances. The casts of the schedule of creditors should also be verified.

Confirmation of balances

The purchase ledger balances should be compared with the confirmation or statement of account received. Any difference must be sorted out.

Amounts which remain unclaimed

If any purchases made remain unpaid for a longer period, the reason for nonpayment is to be looked into. If it sounds reasonable, the unpaid amount may be suggested for write off.

Disputed amounts

Certain amounts due to creditors may be in dispute. Such amounts must be shown as contingent liability and adequately provided for in the accounts.

Fictitious Credits

The bought ledger may be credited with large amount fictitiously to reduce profit. Such credits shown at the end of the accounting year should be thoroughly examined.

Debit balances

Some accounts may show a debit balance. This may be due to discount allowed by the supplier, amount due on goods returned, advance paid to the supplier or any purchase made by the supplier is wrongly accounted through the bought ledger instead of the sales ledger.

The auditor should carefully examine the reasons thereof.

2. Scrutinizing Sales Ledger

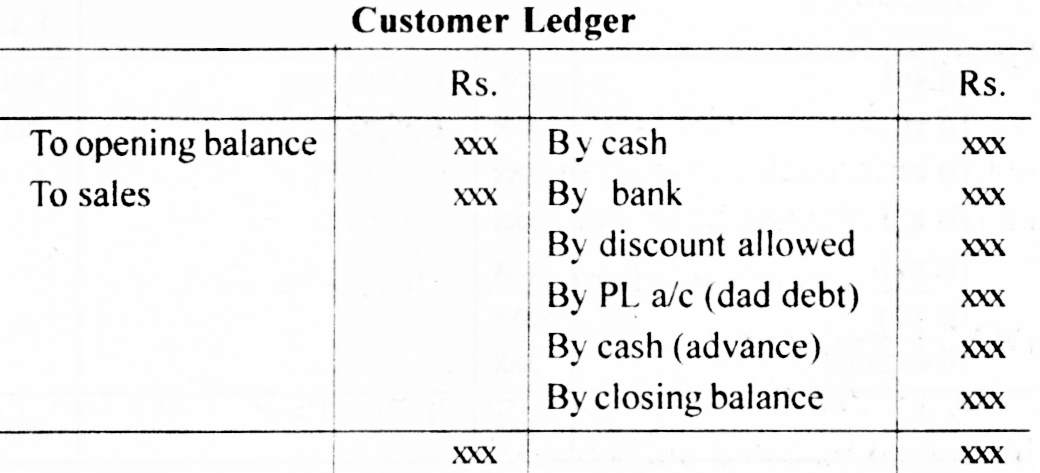

Proforma of a sales ledger account is shown.

While examining the sales ledger, the auditor should consider the following.

Opening balance

The opening balance of sales ledger should be verified with the balance shown in the previous year’s audited balance sheet.

Transfer entries

There may be transfer entries from one ledger to another ledger account.

The auditor should ensure that such transfers are duly authorized by the

responsible officer.

Writing off as bad debt

Before writing off any balance as bad debt, the client should take all efforts to recover the amount or amount should have become time barred. Only the top management can decide to give up the claim and the exact amount to be written off. So, the amounts that are written off as bad debts should be subjected to a scrutiny.

Dispute with customers

If an amount due from the customer is in dispute, the auditor should verify the nature of dispute and amount involved. Adequate provision should be made for the amount considered as non-recoverable.

Confirmation of balance

Obtaining confirmation of balances directly from the debtors is the best audit practice. Any fraud committed or misappropriation of amount collected would come to limelight.

Discount allowed

Cash discount is to be allowed only for prompt payments. If the discount allowed is unreasonable or if the allowance is adjusted against the amount that is outstanding, the same should be scrutinized. It could be a fictitious allowance created by a fraudulent employee who had misappropriated the amount collected from the customers.

Part payment by customers

If the customer makes part payments, then the longest outstanding amount is to be adjusted first.

List of balances

The list of closing balance of debtors should be checked with the sales ledger. After a thorough scrutiny, steps should be taken to ensure that adequate and proper provision has been made for doubtful debts.

The casts and carry forwards of sales ledger should be verified.

Disclosure requirements

Any amount due from directors, managers or concerns in which they are

interested should be listed out separately.

3. Scrutinizing General Ledger

The cash book, purchase book, sales book, sales returns book, purchase returns book are totaled periodically and the summary is posted in the general ledger. The balance in the total account must be equal to the total summary of the respective ledgers.

The auditor should scrutinize the general ledger after verifying the subsidiary books like cash book, sales book, purchases book etc., He should also ensure that standard accounting practices are followed.

As per disclosure requirements, any change in the profit of the year under audit must be disclosed in financial statements.

4. Scrutinizing Main Journal

The transactions of extraordinary nature for which there are no special books of original entry are recorded in journal. A thorough verification of each journal entry is necessary. It is because a crafty entry may entirely change the picture of financial position of the organization.

The supporting evidence for the journal entry will be the minutes of the directors meeting, shareholders meeting, copies of the correspondence etc. Generally, these documents are internally generated. So, confirmation should be obtained from outside sources wherever possible.

Transactions that are usually passed through the journal include opening entries, closing entries, adjustment entries, transfer entries, rectification entries and entries relating to share capital.

1. Opening entries

Opening entries are to be verified with reference to the relevant items found on the balance sheet. For the business purchased from the vendor, relevant entries are passed in the journal. This should be verified with agreement between the client and vendor, articles of association and directors’ minutes to ensure that there is no manipulation of accounts.

2. Closing entries

Closing entries are passed for closing and transferring balances from nominal account to profit and loss account. The auditor should verify whether the balances have been properly carried to accounts.

3. Adjustment entries

The auditor should examine whether all adjusting entries in respect of expenses relating to the period under audit income received in advance and income earned and not received are duly made. He should also scrutinize adjustments in respect of prepaid expenses.

4. Transfer entries

Proper authorization should be obtained for the transfer from one ledger account to another ledger account. The auditor should ensure that direct transfer from one account to another is not made.

5. Entries relating to share capital

Entries for issue of shares, allotment and forfeiture of shares etc., are also passed through the journal.

The auditor should carefully go through the prospectus, articles of association, director’s minutes, applications, copies of allotment letters, correspondence etc., in order to verify these entries.

6. Rectification entries

Sometimes, the entries passed are wrong. For example, an amount to be debited may be credited and vice versa. Rectification entries are required to be passed. The auditor should verify whether all the rectification entries passed are correct and approved by the responsible official.