Importance of hidden cost in financing

Why do hidden cost in finance occur?

The most obvious hidden cost in finance are created by personal guarantees the owners must often provide when a closely held company takes on debt. These guarantees reduce the value of the entrepreneur’s other assets because of the potential claim on them held by the lender to the company. This reduction in asset value is a hidden cost of the borrowing.

Another hidden cost in finance can be in a reduction of the multiple at which the company’s equity is valued. Even though the ROE is higher with greater leverage, a prospective purchaser may not have as much appetite for debt as the seller had when building the company. The purchaser may want an even higher ROE for taking on the risk of the debt. The purchaser can get that requirement only by lowering the price offered for the company.

Excess debt is also a potential problem for an entrepreneur who wants to take the company public. Prospective investors, who have no ability to reduce the level of debt to their liking, will reduce the multiple they will pay for the company’s earnings. Other investors do not invest in companies that plan to use the funds to retire excessive debt.

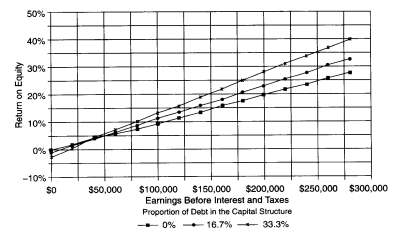

(Return on equity vs Earnings before Interest and taxes)

(Return on equity vs Earnings before Interest and taxes)

Drawbacks of hidden cost in financing:

The existence of hidden cost in finance complicates the interpretation of the information in the above example. It is possible, for example, that hidden costs will reduce the implicit ROE of a high-debt alternative to a lower rate than with a lower- or no-debt alternative. Unfortunately, this assessment requires the entrepreneur’s judgment of the hidden cost in financing. That assessment does explain, however, why many entrepreneurs will not provide personal guarantees and accept lower debt proportions and consequently lower ROEs. The entrepreneur has implicitly assessed the hidden cost in financing and concluded they are greater than the benefits of the debt.

An additional way to think about potential hidden cost in financing is to consider how capital structure decisions affect risk and flexibility considerations.