Exchange rates | Meaning | Methods of Forecasting

Table of Contents

What is an Exchange Rate?

An exchange rate, is the price of one currency expressed in terms of another currency.

The exchange rate among countries are affected by a large number of factors like rate of inflation, growth prospects, political stability, and economic policies. Most of these factors are difficult to predict in advance. As a result, the future exchange rates, like most of the events, become uncertain. Participants in the international markets therefore, face problems, in making decisions which are based on future exchange rates.

For example, future exchange rates may be required by the companies to hedge against potential losses, arranging short-and long-term funds, performing investment analysis, and to assess earnings of a foreign subsidiary. The quality of decision, in such cases, depends on the accuracy of exchange rate projections.

Fixed and Floating exchange rates

The exchange rates may be fixed or floating. Different methods are used to forecast fixed and floating exchange rates. The floating exchange rates, as discussed previously are determined by the market focus of demand and supply. These are not influenced by government intervention. Fixed exchange rates, on the other hand, are decided by the regulating agencies.

Methods of forecasting exchange rates

The floating exchange rates may be forecasted with the help of various methods. Fundamental and technical analysis are commonly used for this purpose.

1. Fundamental analysis method: It studies the relationship between macro economic variables (such as inflation rates, national income growth, and changes in money supply) and exchange rates to forecast the latter. Technical analysis uses past prices and volume movements to project future currency exchange rates.

2. Technical Analysis method: The technical analysis may produce useful results if the past trend is repeated. The companies normally use technical analysis for short-term forecasts. but, they use fundamental analysis for long-term projections.

Primary methods of technical analysis

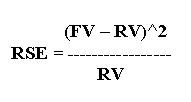

The primary methods of technical analysis are charting and mechanical rules. The reliability of the forecasts may be found out on the basis of forecasting error which is calculated by square root error. The root square error is computed with the help of the following formula:

How to forecast fixed exchange rates?

Fixed exchange rate forecasts are based on the study of government decision-making structure. Attempts is made to determine the pressure to devalue he currency of the nation and the ability of the government to sustain the disequilibrium.

Forecasting fixed exchange rates requires an assessment of balance-of-payments disequilibrium on the basis of key economic variables such as inflation, money supply, international reserves, gap between official and market rates, and the balance of foreign trade.

The change in the exchange rate required to restore the balance of payment equilibrium is estimated with the help of forward exchange rates, free market rates and the purchasing power parity principle. The capacity of the country to resist or postpone the use of corrective measures is evaluated on the basis of the ability to borrow hard currencies and the availability of international reserves. Attempt is also made to project the policies which may be followed by the Government to correct the position of the nation.

Thus, exchange rates are forecasted to make various decisions by the companies which require foreign exchange. These forecasts are made separately for the fixed and floating exchange rates with the help of different methods. Percentage change between forecasted and current exchange rates may be calculated to find out appreciation or depreciation in the currency.