Audit Planning & Developing an Active Audit Plan – Considerations, Advantages

Table of Contents

Audit Planning

Planning brings promptness and perfection in performance. Planning in audit operations is considered as an essential prerequisite. It enables an auditor to cover different aspects of audit work in a systematic and methodical manner. Audit planning enhances the quality of audit work.

Considerations in Audit Planning

Audit plans should be based on the knowledge of client’s business. The auditor should so plan his work that audit may be conducted in an effective and efficient manner. Due regard must be paid to client’s accounting system, policies and internal control procedures. The extent to which internal control system may be relied on is also important. Determination of audit procedures helps coordination of work. The audit plan should be revised as and when necessary.

The following factors should receive due consideration while planning.

1. The size of the company and complexity of its operations,

2. Environment in which the company operates,

3. Previous experience with the client; and

4. Knowledge of client’s business.

Knowledge of the Client’s Business

Knowledge of the client’s business is very important. This will help the auditor identify the events, the transactions and practice that impact the financial information. Client’s business can be known from

- Annual reports to shareholders,

- Minutes of meetings of shareholders, directors and committees,

- Financial reports such as budgets submitted to management,

- Audit working papers in the previous year,

- Employees doing non-audit services,

- Discussion with the client,

- Company news figured in publication of the institutes, professional bodies, trade journals, magazines, newspapers, etc.,

- Visits to the premises and plant facilities.

Advantages of Audit Planning

An effective, efficient and timely audit needs audit planning. A well drawn audit plan offers the following advantages.

1. It provides right means to accomplish audit objectives.

2. It ensures that no important area is left out. All important areas of management receive attention.

3. It helps in identifying potential problems.

4. It ensures timely completion of audit work.

5. It facilitates coordination of the audit work done by auditors and other experts.

6. It helps in improving the quality of audit work.

7. Good planning brings promptness and perfection in audit performance.

Developing an Active Audit Plan

An audit plan gives not only the scope of audit but also facilitates smooth flow of audit work. Matters given below should be considered while developing the over all audit plan.

1. The terms of his appointment and statutory responsibilities.

2. The nature, extent and timing of reports and other correspondence.

3. Legal requirements.

4. Accounting policies followed by the client and changes therein.

5. Identifying important audit areas.

6. Items that require special attention e.g. transactions with outsiders in whom directors have special interest.

7. Internal control in operation and the degree of reliance to be placed on it.

8. Shifting of emphasis on specific audit areas.

9. Audit evidence to be obtained.

10. Role of internal auditors and their involvement in audit

11. Role of other auditors in the audit of subsidiaries or branches of the company.

12. Services of experts involved in the company work.

13. Allocation of work among joint auditors and control and review procedures thereon.

14. Staff requirements for the audit work.

Depending upon the scope of audit work, the audit plan should be well documented.

Preparation before Audit

Preparation before audit refers to preliminary arrangements made by the auditor before commencing audit work. On being appointed for the first time, the auditor should do the following.

- Entering into an agreement with the client.

- Ascertaining the scope of audit work.

- Knowing about the client’s business.

- Knowing about the accounting system in use.

- Ascertaining technical details.

- Giving instructions to and obtain information from the client.

1. Agreement with the Client

Having accepted an audit engagement, the auditor should enter into an agreement with the client. Such agreement should deal with

- Nature of audit.

- Date of commencement of audit.

- Date of completion of audit.

- Remuneration for the audit.

- Extent of duties and responsibilities.

If an auditor is appointed to replace another auditor, he should enquire from his predecessor, the reasons for the change.

2. Scope of Audit work (Audit Engagement Letter)

The scope of audit may be ascertained with reference to relevant statute. Generally, the audit engagement letter spells out scope of audit work in explicit terms. The auditor has to be well prepared accordingly. Sometimes, a full audit is required whereas in certain cases an audit is only for specific purpose. For example, joint stock company may ask for tax audit only.

Contents of audit engagement letter

An audit engagement letter generally includes reference to the

- Objective of audit of financial information.

- Provision of financial information by the management.

- Applicable legislation, regulations or pronouncements of professional bodies to which the auditor adheres to

- Access to information sources and records

The auditor at his discretion may include the following.

- arrangements for planning of audit.

- Written confirmation by management for representations made in relation to audit.

- request from the client for acknowledging receipt of engagement letter.

- description about the reports he expects to issue to the client.

- fee computation and billing arrangements.

- a reference to any further agreement between the auditor and the client.

- involvement of other auditors, experts, internal auditors and other client’s staff in some aspects of the audit.

3. Knowledge of the Client’s Business

As discussed under considerations in audit planning, a client’s business can be well understood from

- Shareholders’ report

- Minutes of the meetings

- Internal reports including budgets

- Previous year’s audit working papers

- Non-audit services personnel

- Discussion with client

- Company policy and procedures manual

- Publications relating to companies

- State of the economy and its effect on client

- Visits to premises and plant facilities

4. Knowledge of the Accounting System in Use

The auditor should study the accounting system followed by the client company. The auditor should ask for a list of books of accounts maintained and names of employees responsible for their maintenance and specimen signatures of such employees.

He should also examine the internal check system as a sound system of internal check can minimize chances of errors and frauds in the books of accounts.

5. Information about Client’s Staff

The auditor should collect a list of principal officials of the company, together with the particulars of work assigned, scope of their authority and their specimen signatures. The auditor may go through organisation chart and manuals depicting the organisation. Memorandum of association, articles of association may also be studied to have a better understanding of the company affairs.

6. Technical Details

If the client’s business is of a technical nature, the auditor should familiarize himself with important technical details of that business. He should visit the workplace and acquire some technical knowledge to conduct the audit efficiently.

7. Instructions to and Information from Client

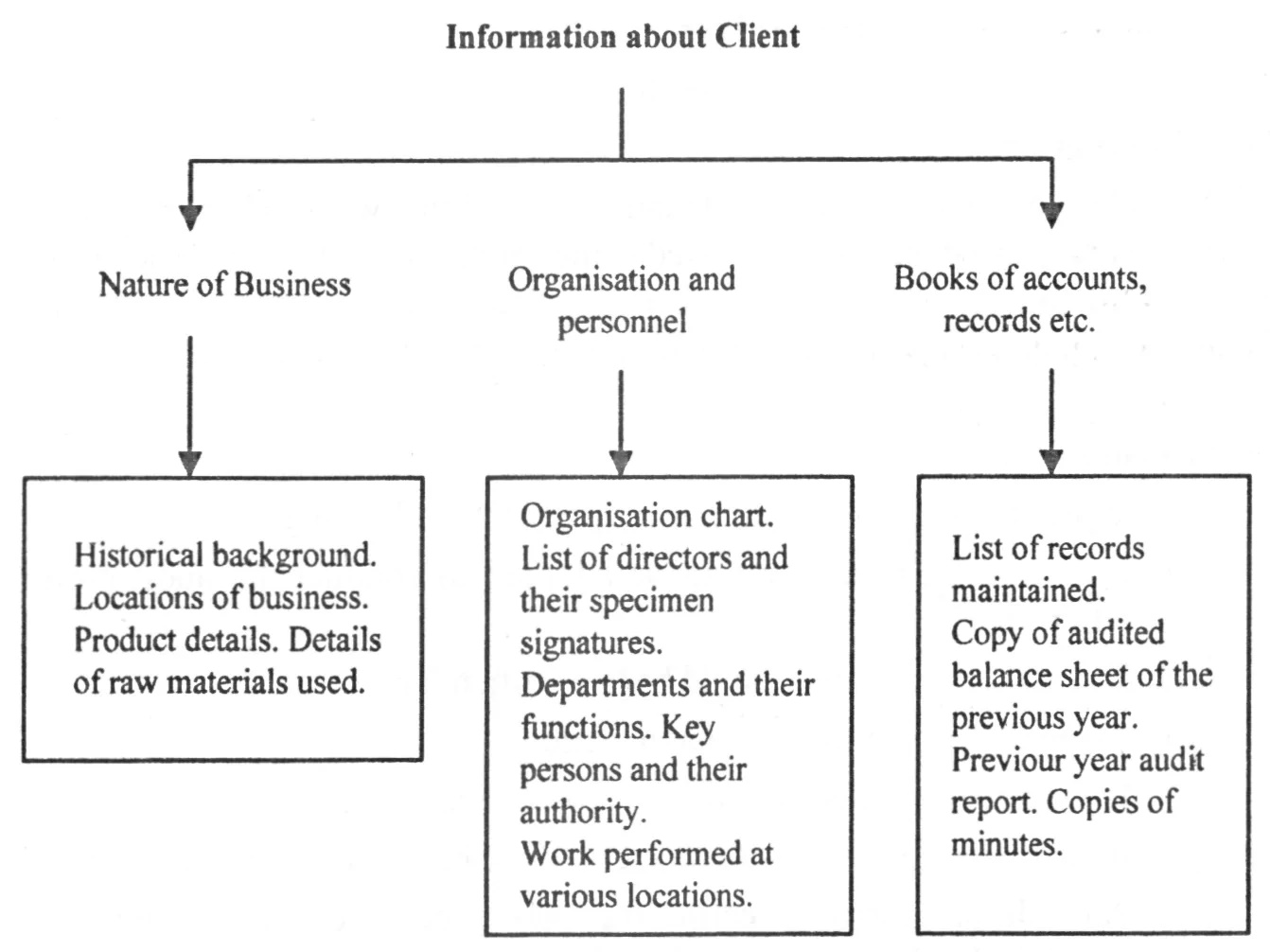

The auditor should obtain information on nature of business, organisation and personnel, books of accounts, records, etc.

Information to be collected by the Auditor from client

After knowing about the client, the auditor should instruct the client to keep all the financial records and other statements ready for audit. His instructions to the client will be on the following lines:

- The final accounts (trading and profit and loss account) and the balance sheet should be ready for audit.

- The cash book and bank pass book should be upto date.

- Ledger postings should be complete and duly balanced.

- The vouchers should be arranged serially.

- Trial balance should be kept ready.

- Statement and schedules regarding financial matters should be prepared.

- Statements of bad and doubtful debts.

- Schedule of debtors and creditors.

- Investments statement at cost price and market values.

- Statement of outstanding income and expenses.

- Statement of prepaid expenses.

- Stock sheets showing the value of closing stock along with the method of valuation of stock.

- Statement of capital expenditure.

- List of deferred revenue expenditure.