Working capital | Operating Cycle or Circular Flow Concept

Table of Contents

Working Capital

Working capital refers to a part of sources of funds of a business concern used for financing short term purposes or current assets such as cash in hand, cash at bank, marketable securities, bills receivables, stock of raw materials, work in progress and finished goods, consumable stores, advance payment of tax, prepaid expenses and the like.

What is circulating capital?

The funds invested in the form of current assets can be converted into cash as early as possible at the maximum of within one year. This cash flows again used for having other forms of current assets and converted into cash. Hence, it is also known as revolving or circulating capital.

Operating Cycle or Circular flow concept of Working Capital

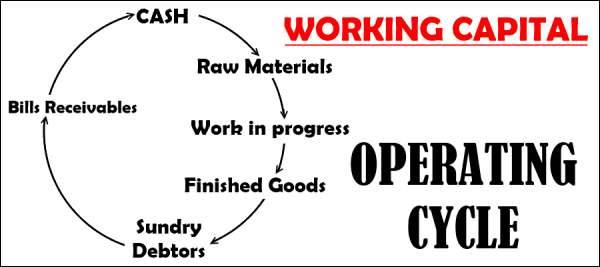

The circular flow concept of working capital is based upon the above operating or working capital cycle of a firm. The operating cycle starts with the time of placing the order for receiving the raw materials and ends with the time of receiving cash from the sale of finished goods. Hence, it is inferred that more amount of working capital is required if there is any long period of operating cycle and vice versa.

The following chart clearly explains the working capital operating cycle.

Generally, gross operating cycle of a firm is equivalent to the span of the inventories and conversion period of the receivables.

Gross Operating Cycle = RMCP+ WIPCP+FGCP+RCP

- RMCP = Raw materials conversion period.

- WIPCP= Work in progress conversion period.

- FGCP = Finished goods conversion period.

- RCP = Receivables conversion period.

RMCP = ( Average Stock of Raw Materials/ Raw Material Consumption per Day)

WIPCP = (Average Stock of work in progress / Total cost of production per day)

FGCP = (Average stock of finished goods / Total cost of Sales per day)

RCP = (Average Accounts Receivables / Net credit sales per day)

Sometimes, business concern may receive the raw mate6als on credit basis. If so, cash cannot be paid immediately. Cash will be paid at the end of the credit period i.e time allowed by the suppliers. In this case, defer payment period is deducted from the gross operating cycle period to get net operating cycle period.

Net operating cycle period = (Gross operating cycle period – Payable Deferal Period)

Payable Deferal Period = (Average Payables / Net Credit Purchases per day)