Flow of Funds | Procedure for finding flow of funds

What is flow of funds?

Flow means movement. The term movement includes inflow and outflow. Here, flow of funds means transfer of economic values from one asset of equity to another. In other words, flow of funds refers to movement of funds in the working capital.

A business transaction may bring a change in working capital either in the form of decrease or increase. If there is change in current assets and current liabilities in the same direction and by the same amount, there will be change only in their amount but no change in the working capital. Hence, there is no flow of fund in such type of transaction.

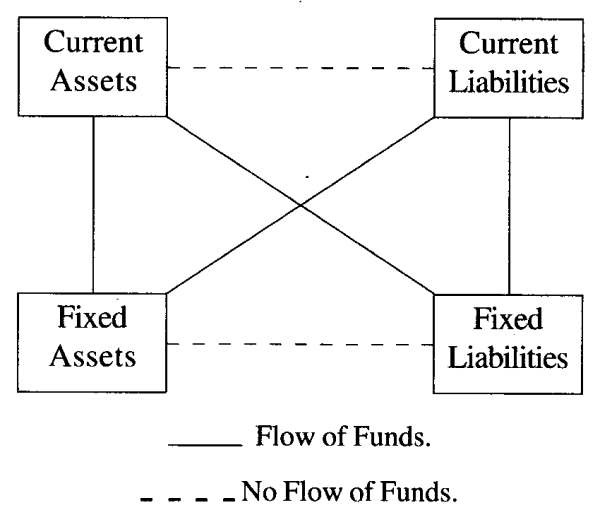

In simple words, there is a flow of funds if a transaction affects

- a current asset and a fixed asset or

- a fixed and a current liability or

- a current asset and a fixed liability or

- a fixed liability and current liability.

There is no flow of funds if the transaction assets fixed assets and fixed liability or current assets and current liabilities.

Procedure For Finding The Flow Of Funds

The following procedure can be adopted to find the flow of funds from a transaction.

- A detailed analysis of a specific transaction.

- Find the accounts involved in the specific transaction. Generally, there are two accounts involved.

- Out of two accounts, find whether the involved accounts are current or fixed in nature.

- If both accounts are current in nature, there is no flow of funds.

- If both accounts are fixed in nature, there is no flow of funds.

- If one account is current in nature and another account is fixed in nature, there is a flow of funds.

The following example disclose the flow of funds very clearly.

Example:

- Cash paid to creditors Rs.10,000.

- Purchase of building in exchange of Equity Shares Rs.50,000

- Issues of Debentures for cash Rs.1,00,000.

- Purchase of Plant and Machinery from M/s. Anand & Co., on credit Rs.75,000.

The above transactions are analyzed to find the flow of funds.

First Transaction: Cash paid to Creditors.

Step 1: Two accounts are involved. They are cash a/c and creditors a/c.

Step 2:

| Cash a/c | Current Asset |

| Creditors a/c | Current Liabilities |

Inference: Both accounts are current in nature, hence, there is no flow of funds.

Second Transaction: Purchase of building in exchange of Equity Shares.

Step 1: Two accounts are involved. They are Building a/c and Equity Share Capital a/c.

Step 2:

| Building a/c | Fixed Asset |

| Equity Share Capital | Fixed Liabilities |

Inference: Both the accounts are fixed in nature, hence, there is no flow of funds.

Third Transaction: Issue of Debentures for cash.

Step 1: The accounts are involved. They are Cash a/c. and Debentures a/c.

Step 2:

| Cash a/c | Current Assets |

| Debenture a/c | Fixed Liabilities |

Inference: Out of two accounts, one account is current in nature and another account is fixed in nature. Hence, there is a flow of funds.

Fourth Transaction: Purchase of plant & machinery from M/s. Anand & Co., on credit.

Step 1: Two accounts are involved. They are Plant and Machinery a/c and M/s. Anand & Co., a/c.

Step 2:

| Plant of Machinery a/c | Fixed Asset |

| M/s.Anand & Co. | Current Liabilities |

Inference: Out of two accounts, one account is current in nature and another account is fixed in nature. Hence, there is a flow of funds.

The following picture shows the flow of funds very clearly.