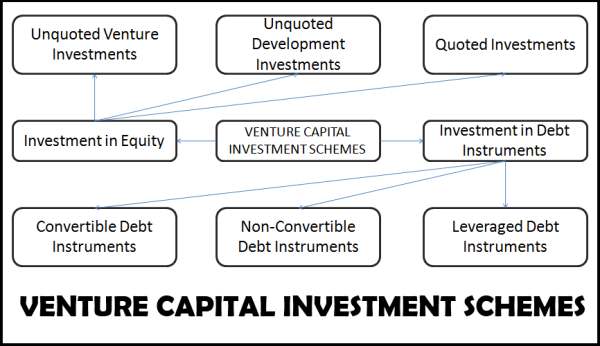

Types of Investments by Venture Capital Institutions (VCI)

A venture capital institution may go in for different schemes for investment. It can be on the basis of

- Investment in Equity

- Investment in Debt instruments.

Table of Contents

Investment in equity

Investment on the basis of equity is of three types. They are

- Unquoted venture investments,

- Unquoted development instruments; and

- Quoted investments.

1. Unquoted venture investments: Here, the company in which investments are undertaken are companies which are not quoted. But the value of these investments is made through a reliable source and is also based on operating performance of the company. For this purpose, the P/E ratio (price divided by earnings) is taken which will give a fair idea about the performance of the borrowing companies.

2. Unquoted development instruments: Here, the venture capital is invested in companies which are earning profits and where the venture capital could be withdrawn within a reasonable period. Still, these securities do not enjoy a market value. Here also the P/E ratio could be applied. But due allowance should be given for the liquidity of the investment.

3. Quoted investments: Here, the borrowing companies in which venture capital are invested would have reached a stage of maturity and hence the venture capital could be withdrawn. In such cases, the value of the shares can be easily assessed from the market. Discount can be given on the value, according to the market conditions.

Investment in Debt Instruments

1. Convertible debt instruments: These debt instruments are convertible into equity shares at a particular time and price. The value of these instruments will also be made either under market value method or under fair value method.

2. Non convertible debt instruments: Here, the debt instruments cannot be converted into equities but they will have fixed interest or zero interest bonds.

3. Leveraged debt instruments: Here, adequate flexibility is given to venture capital companies so that they can convert a part of their debt instruments into equity and a part of it as debentures. It will depend upon market conditions, earnings of the company and tax structure.

How do Venture Capital Institutions exit an Investment?

Here, the venture capital company plans to come out of the borrowing concern which is otherwise called disinvestment. This can be done either by converting capital into equity or by selling it as shares to other companies or selling it to a new investor. Sometimes, the venture capital company may also seek legal measures for getting out of the borrowing concern.

When a venture capital company gets out on its own, it is a voluntary exit. But when it resorts to legal measures, it is an involuntary exit.