Relationship between Assets, Capital Structure, and Dividends

The capital-structure decision for the smaller company is both less complex and more critical than for the large corporation. It is simpler because there are fewer alternatives for non-equity financing. It is more critical because if there are financial-structure problems, the smaller company has much less room to maneuver. Its lenders, having little at stake, are less inclined to spend time working out the problem. Although the analytic approach to capital-structure decisions does not depend on the company’s size, the relative weight placed on the decision’s components may vary.

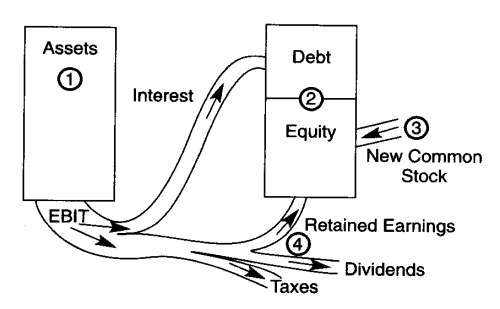

A net increase in working capital and long-term assets (use of funds) can come from only two sources: an increase in long-term debt or an increase in equity (or a combination of the two). The increase in equity can be the result of an increase in preferred stock (not usually an alternative avail-able to a smaller company except to high-growth ventures) or an increase in the common shareholders’ equity (or both). Common equity, ignoring preferred stock as a specialized financial instrument, can come only from two sources: retained earnings or the issue of new common stock (or both). Retained earnings are the result of profits earned on the assets after distributions to the government for income taxes, to senior-security holders for interest and preferred dividends, and to the common stock-holders as dividends. These relationships are illustrated in the image below.

Interrelationship Of Capital Structure Decisions

The capital structure establishes the cost of capital, which should determine the investments that can profitably be made. On the other hand, there is evidence that the nature of the investments determines the efficient capital structure. Given this circularity, the decision maker could start with either decision and work interactively with both to create the maximum value.

FINANCIAL MANAGEMENT: Generally, and particularly with the smaller company, you make the asset decisions first. The opportunity to invest often creates the need for capital. In addition, investment decisions are typically easier to make, given a rough estimate of the entrepreneur’s capital costs. Unlike the managers of a large corporation, you can directly assess the return you demand for an investment. You can balance the return against the risks you identify as associated with the project.

Once the asset decisions are made, Decision 1 in the example above, the operating earnings are determined. The capital structure question, Decision 2, is how to divide the operating flows, the earnings before interest and taxes (EBIT), between senior and junior sources of capital and the government. How much the government takes in income taxes depends on the proportion of the stream paid out in a form that is deductible from the EBIT before the tax calculation is made.

Decision 3 is the decision about whether to issue new equity. For privately held companies, the answer to this question is typically “No.” That is the answer for many public companies as well unless the investments are extraordinarily profitable or the company is in deepest distress.

With three out of four decisions already made, Decision 4, the dividend-payout percentage, is set by default. For that reason, the dividend policy is often considered a residual decision. It distributes to the shareholders what is left after the other decisions have been made.

IMPORTANT: If the dividend decision is not the default decision, then another decision must be left as the residual. For example, if the asset decision and the capital-structure decisions are considered inviolable, then any equity shortfall must be made up by issuing new equity rather than by cutting the dividends.

This action will dilute the ownership of the existing shareholders and dampen their per-share growth in value. If you believe the asset decision is essential but are unwilling to raise new equity to replace the dividends that exceed the maximum residual flows, debt must be raised to provide the missing capital. This action will increase the debt-equity ratio, a change not sustainable in the long run. Finally, if you believe that the debt-equity proportions should be maintained and no new equity raised, then the asset-investment program must be curtailed. This action creates the risk that the company will lose market position because it is under investing.

Example: Consider a company that requires $100,000 net additions to its assets. The firm’s debt-to-capital policy is 40 percent, and debt is now at that proportion of the capital structure. The company can therefore raise only $40,000 from additional debt to finance the $100,000 addition to assets. The other $60,000 must come from equity.

If the firm’s profits after taxes are $120,000, it can pay only $60,000 in dividends, a payout ratio of 50 percent. If management wishes (or has had the policy) to payout 60 percent of profits, the company will be $12,000 short of the equity it needs to fund the increase in assets. If this cannot be raised from new equity, a change must be made in either the asset-investment or the capital-structure policies.

Some companies have the luxury of slack financial resources: spare cash or debt capacity. This resource is only available once, however, and regenerating the spare resources takes a long time once it is used. Unwise expansions can prove major disasters when entrepreneurs extend their businesses into new locations not easy to control or get over their heads in new businesses they do not understand.

Therefore,you need to understand the considerations useful in setting up a proper capital structure. Part of the analysis will be static, assuming the asset side of the balance sheet is fixed and illustrating how to analyze the effects of different capital structures. Part of the analysis will be dynamic, showing how financing asset growth results in changes in future years as the effect of the investments appears in the income statement.

FINANCIAL MANAGEMENT: The purpose of dividing a company’s earnings flows to support various categories of securities, basically debt and equity, is to increase the total value of the company compared to the company’s value in a plain, unadorned, total-equity version.

The chief financial officer’s task thus contains a marketing component. The CFO is responsible for creating as much present value as possible by packaging and selling the company’s prospective earnings in the most appropriate and valuable manner.