Depository system and Dematerilization | Functions | Procedure | Benefits

Table of Contents

What is a depository system?

Introduction of Depository system gives way for dematerialization of shares. A Depository is an organization which holds the securities of a shareholder in electronic form at the request of the shareholder.

The development of Information technology has paved the way for many innovative things in the stock exchange. The stocks scam which shook the stock market during the 1990s also made the government to take preventive measures to avoid the recurrence of such scams. All these resulted in the introduction of a new type of stock trade called dematerialization.

What is Dematerialization:

Under dematerialization of shares, physical transfer of shares is avoided and the transactions take place through the electronic media. This saves time and stationery and also prevents the loss of documents in transit.

Functioning of Depository System

The depository system will not only maintain the accounts of the shareholder but will also undertake to collect dividends, bonus shares, etc., on behalf of the shareholder. Periodically, the shareholders will be informed of their holdings by a Depository agent through a statement of accounts. Any sale or purchase of shares will take place through the Depository. The use of electronic system in the transfer of shares is an important aspect of Depository system.

Structure of Depository System

- Central Depository

- Share Registrar Transfer Agent

- Clearing and Settlement Corporation

- Depository Participant

Central Depository

Central depository is an organization with which all the shares, belonging to the shareholders are kept and the electronic system takes care of them.

Share Registrar is an authority who controls the issue of securities. Along with this, the transfer agent arranges for the transfer of securities in the case of buying or selling of securities.

Clearing and Settlement Corporation:

This agency settles the transfer of funds between the seller and buyer.

Depository Participant (D.P):

He is like a share broker and he trades as per the instructions of the shareholder in and outside the stock exchange.

An ID Account number is given by the Depository Participant (D.P) to every shareholder when he/she opens an account for dematerializing the securities. D.P is a representative in the depository system on behalf of the shareholder and he only intimates to the shareholder periodically the securities account held by the customer. As per SEBI regulations, financial institutions, banks, stockbrokers, etc., can be Depository Participants.

Procedure in the Depository system

When the shares are handed over to the depository system, the shares get immobilized as they are no more with the shareholder in physical form.

Notification by Stock Exchange

The stock exchange concerned where the shares are listed will come out with a notification for the dematerialization of shares.

Dematerialization Form

The shareholder will obtain the Dematerialisation request form from the Depository Participant. This form will contain details about the name of the company, folio number and the distinctive number of the shares which are given for dematerialization. The form will be signed by either the single owner if it is held so or by joint owners, when they are held jointly.

When the D.P hands over the securities to the depository, the securities will be sent to Share Registrar who will register the depository name and the particulars of shares. But, before doing this, the ownership of the securities should be verified with the company and hence, this procedure will take some time.

In case the signature in the requisition form does not tally with the specimen signature held by the company, then the request for dematerialization will be rejected as it amounts to bad delivery.

Crediting the investor account

In the last stage, the Depository will inform the D.P the details of shares registered in the name of the shareholder concerned. On this basis, the D.P will send the Statement of Account, to the customer shareholder.

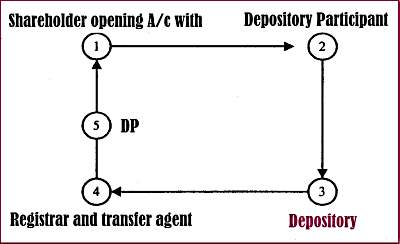

This completes the dematerialization procedure. We can explain this in the following diagram:

We have so far discussed about the sale and purchase of securities in the secondary market. But when a shareholder applies for a company security in the primary market, he will mention his ID Account number in the application form.

When a seller agrees to sell certain securities to the buyer, the seller will fill up a form known as ‘Delivery Instructions form’.

This form will contain details about the number of shares to be sold and the account number of the shareholder with the Depository Participant. In fact, some Depository participants even print this form with the ID Account number and name of the client.

There are two types of Delivery Instructions forms. They are

- Off-market trade and

- Market trade.

Off market trade will not be routed through the stock exchange. It may be a transfer among the family members. Market trades are those which are traded in the market.

The seller signs the form and hands it over to his depository participant through the broker who has effected the transaction. The depository participant will then send it to the Depository. The Depository on receipt of this request, will debit the free balance of the seller and credit the available balance of the buyer.

The available balance of the buyer will be converted into free balance once payment for the transaction is effected. When once the buyer has free balance, he has a right to transfer or sell to any other person.

Benefits of Depository system:

1. Depository system takes hold of all securities in the country listed in that particular stock exchange.

2. Introduction of electronic system enables speedy transactions and accuracy.

3. In a depository system, the security holders can sell and buy securities by which liquidity is brought to the securities.

4. Blank transfers are avoided and holding of shares in Benami names is also prevented.

5. Registration and stamp charges for the sale of securities could be easily collected by the government which was evaded under the previous system.

6. Depository promotes more activity in the capital market as trading in genuine share. is ensured under Depository system.

7. Depository avoids use of stationery and prevents delay in registration of transfers.

8. Dividend and interest on securities are properly distributed through this system and in the case of convertible debentures, on the due date, the securities are converted into company shares.

9. Depository acts as collateral security for the raising of 1oans from any financial institution.